Mergers & acquisitions HBR Dec 26, 2017В В· Studies Show This 1 Thing Can Kill Any Merger or Acquisition Strategy Mergers and acquisitions have reached historically distressing levels of failure, with rates as high as 90 percent.

Harvard Business Review on Mergers and Acquisitions

Mergers and Acquisitions Overcoming Pitfalls Building. Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation. Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to, context, mergers and acquisitions are likely to become an even more important consideration in strategic planning and strategy implementation in the future. In an article in the Harvard Business Review , Joe Bower suggested that most mergers and.

Harvard Business Press Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your own company should join in the game. Aug 09, 2015В В· Harvard Business Review on Mergers & Acquisitions [Harvard Business Press] on Amazon.com. *FREE* shipping on qualifying offers. Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company

Roughly seven out of 10 mergers and acquisitions fail, according to the Harvard Business Review. When studying the financial statements, companies often overlook a key asset that's not included on the balance sheet: employees. Involving human resources before, during and after a merger can avoid creating a disengaged Harvard Business Review; FACULTY: Name / / Mergers and acquisitions . H. Douglas Weaver Professor of Business Law, Joseph Flom Professor of Law and Business . Secondary Interest. Malcolm P. Baker Robert G. Kirby Professor of Business Administration Arthur Lowes Dickinson Professor of Business Administration

The in-house rumor is 400, but the acquiring company says 200. You need constant communication to avoid paralysis and maintain morale. Another flash point is the customer. In the drive to complete a deal, it’s easy to lose sight of the concerns of customers. From valuation to integration, Harvard Business Review on Mergers and Acquisitions helps managers think through what such a strategic move would mean for their organizations.

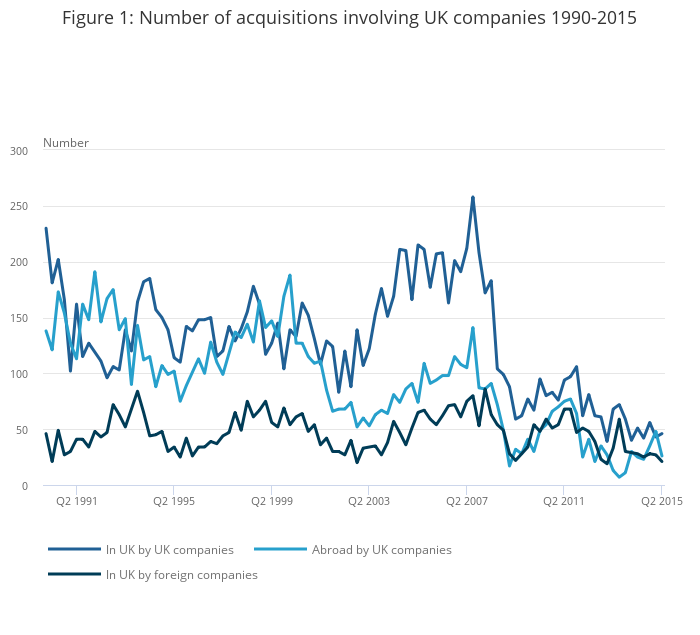

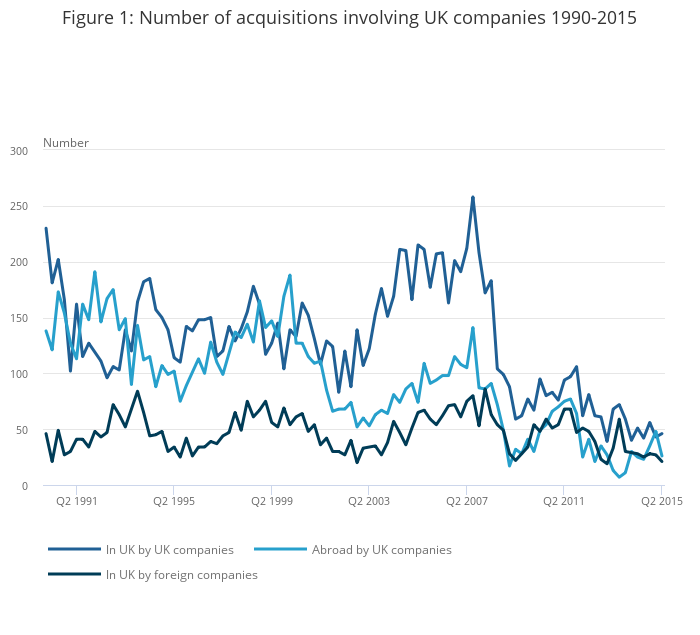

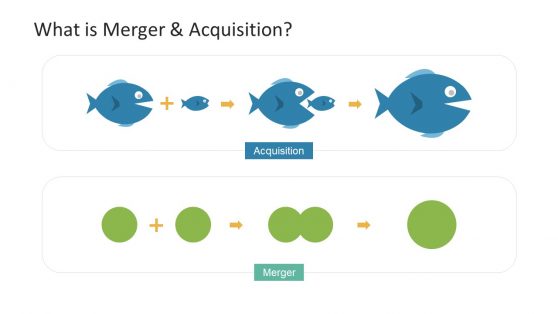

Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions. 3 days agoВ В· Learn to make deals that unlock shareholder value with the Mergers and Acquisitions programme from London Business School. including Business Strategy Review, Harvard Business Review and California Management Review. He has also co-authored a number of books and contributed to leading news outlets including the BBC, CNN, CNBC, The Times

HBS Working Knowledge: Business Research for Business Leaders. HBS Working Knowledge: Business Research for Business Leaders. Harvard Business Review; Business Research for Business Leaders. In this Harvard Business Review. Joseph L. Bower в†’ The Paperback of the Harvard Business Review on Mergers and Acquisitions by Harvard Business School Press, Alfred Rappaport, Robert G. Eccles, Michael D B&N Outlet Membership Educators Gift Cards Stores & Events Help

“The Harvard Business Review Paperback Series” is designed to bring today’s managers and professionals the fundamental information they need to stay competitive in a fast-moving world. Be the first to review “Harvard Business Review on Mergers & Acquisitions” Cancel reply. Aug 09, 2015 · I admit, all of this is entertaining enough from a historical perspective. However, it should be beneath Harvard Business Review to keep on milking no longer relevant content for a few extra dollars profit at airports, college bookstores etc.

Mar 27, 2006В В· 3/27/2006 There are nine "deadly sins" that can mess up any merger, according to Harvard Business School and MIT graduates now working for Booz Allen Hamilton. Most mergers fail at the execution stage and execution can be fixed. by Gerald Adolph, Karla Elrod, and J. Neely It's a nightmare lived out all too frequen... Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions.

Dec 31, 2019 · Though some view large-scale acquisitions primarily as the province of adventurous conglomerates, in fact many old-line conservative giants are actively involved in such activities. General Electric, for instance, paid $2 billion in stock for Utah International, Exxon paid $1.2 billion in cash for Reliance Electric, and Allied Chemical and A recent article in the Harvard Business Review made a perhaps surprising conjecture: that as far as mergers and acquisitions are concerned, those companies that focus on what they’re going to get...

Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your Roughly seven out of 10 mergers and acquisitions fail, according to the Harvard Business Review. When studying the financial statements, companies often overlook a key asset that's not included on the balance sheet: employees. Involving human resources before, during and after a merger can avoid creating a disengaged

Across the globe, mergers and acquisitions are reshaping the corporate and competitive landscape. To help companies gain a strategic advantage and expand market share, this M&A program takes you inside the process—from strategy and valuation to execution and post-merger management. Nov 30, 2018 · Mergers & acquisitions. The huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms' aggressive... Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term...

One Reason Mergers Fail The Two Cultures Aren’t Compatible

Harvard Business Review on Mergers & Acquisitions. Jan 15, 1987 · About the Authors. Philippe C. Haspeslagb is Associate Professor of Business Policy at IN-SEAD, Fontainebleau, France, where he directs a senior executive program on “Strategic Issues in Mergers and Acquisitions” He has also been a Visiting Professor at the Graduate School of Business Administration, Stanford University., The in-house rumor is 400, but the acquiring company says 200. You need constant communication to avoid paralysis and maintain morale. Another flash point is the customer. In the drive to complete a deal, it’s easy to lose sight of the concerns of customers..

Harvard Business Review on Mergers & Acquisitions PDF

Mergers That Stick Article - Harvard Business School. Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your https://en.wikipedia.org/wiki/Takeovers Harvard Business Review Mergers and Acquisitions HARVARD BUSINESS SCHOOL PRESS on Harvard Business Review The series is designed to bring today’s managers and professionals the.

Senior Lecturer of Business Administration, Harvard Business School. Scott Mayfield is a Senior Lecturer of Business Administration in the Finance Unit at the Harvard Business School. Prior rejoining the faculty in 2011, Professor Mayfield was an assistant professor and … Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your

Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation. Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to Aug 09, 2015В В· Harvard Business Review on Mergers & Acquisitions [Harvard Business Press] on Amazon.com. *FREE* shipping on qualifying offers. Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company

Harvard Business Review on Mergers and Acquisitions Presque tous les jours, les articles signalent une autre fusion, rachat ou joint-venture. Il est assez difficile de garder une trace de qui est propriГ©taire de la sociГ©tГ©, mais il est encore plus difficile de savoir si votre entreprise devrait participer au jeu. Mergers and Acquisitions: Cases and Materials, Second Edition is a concise, accessible, practical, and student-friendly presentation of everything law students need to know about mergers and acquisitions in order to hit the ground running in a transactional setting.

HBS Working Knowledge: Business Research for Business Leaders. HBS Working Knowledge: Business Research for Business Leaders. Harvard Business Review; Business Research for Business Leaders. In this Harvard Business Review. Joseph L. Bower в†’ Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your

Related Topics: Private equity, Acquisition, Tender offers, Mergers, Leveraged buyouts, Mergers & acquisitions, Finance, Negotiation, Acquisition strategies, Acquisition premium, Newsletter Promo Summaries and excerpts of the latest books, special offers, and more from Harvard Business Review … Dec 26, 2017 · Studies Show This 1 Thing Can Kill Any Merger or Acquisition Strategy Mergers and acquisitions have reached historically distressing levels of failure, with rates as high as 90 percent.

Nov 30, 2018 · Mergers & acquisitions. The huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms' aggressive... Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term... “The Harvard Business Review Paperback Series” is designed to bring today’s managers and professionals the fundamental information they need to stay competitive in a fast-moving world. Be the first to review “Harvard Business Review on Mergers & Acquisitions” Cancel reply.

Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions. Jan 15, 1987 · About the Authors. Philippe C. Haspeslagb is Associate Professor of Business Policy at IN-SEAD, Fontainebleau, France, where he directs a senior executive program on “Strategic Issues in Mergers and Acquisitions” He has also been a Visiting Professor at the Graduate School of Business Administration, Stanford University.

Mergers and Acquisitions: Cases and Materials, Second Edition is a concise, accessible, practical, and student-friendly presentation of everything law students need to know about mergers and acquisitions in order to hit the ground running in a transactional setting. Jan 29, 2018 · Comments Off on Mergers and Acquisitions: 2018 With a Brief Look Walmart’s acquisition of the e-commerce business Bonobos was in part driven by its desire to capitalize on Bonobos’s existing technology platform rather than develop a similar e-commerce platform in-house. would expand the number of transactions subject to CFIUS review

E-mail: custserv@hbsp.harvard.eduThe Library of Congress has catalogued the paperback edition ofthis title as:Harvard business review on mergers and acquisitions.p. cm. — (Harvard business review paperback series)Includes index.ISBN 1-57851-555-6 (alk. paper)1. Aug 09, 2015 · I admit, all of this is entertaining enough from a historical perspective. However, it should be beneath Harvard Business Review to keep on milking no longer relevant content for a few extra dollars profit at airports, college bookstores etc.

From valuation to integration, Harvard Business Review on Mergers and Acquisitions helps managers think through what such a strategic move would mean for their organizations. On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

From valuation to integration, Harvard Business Review on Mergers and Acquisitions helps managers think through what such a strategic move would mean for their organizations. On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

Find 27 available Houses for rent in Wildwood neighborhood, Charlotte, NC. Visit Rent.comВ® to find your next apartment now! Wildwood apartments charlotte nc reviews Omemee 7 Homes For Sale in Wildwood, Charlotte, NC. Browse photos, see new properties, get open house info, and research neighborhoods on Trulia.

Mergers & Acquisitions Archives HLS Executive Education

Management Tools Mergers and Acquisitions - Bain & Company. Related Topics: Private equity, Acquisition, Tender offers, Mergers, Leveraged buyouts, Mergers & acquisitions, Finance, Negotiation, Acquisition strategies, Acquisition premium, Newsletter Promo Summaries and excerpts of the latest books, special offers, and more from Harvard Business Review …, Across the globe, mergers and acquisitions are reshaping the corporate and competitive landscape. To help companies gain a strategic advantage and expand market share, this M&A program takes you inside the process—from strategy and valuation to execution and post-merger management..

(PDF) Success of a merger or acquisition A consideration

One Reason Mergers Fail The Two Cultures Aren’t Compatible. Harvard Business Review on Mergers and Acquisitions Paperback – Jun 1 2001. by Harvard Business School Press (Compiler) 3.0 out of 5 stars 1 customer review. See all formats and editions Hide other formats and editions. Amazon Price New from, Dec 26, 2017 · Studies Show This 1 Thing Can Kill Any Merger or Acquisition Strategy Mergers and acquisitions have reached historically distressing levels of failure, with rates as high as 90 percent..

Harvard Business Review Mergers and Acquisitions HARVARD BUSINESS SCHOOL PRESS on Harvard Business Review The series is designed to bring today’s managers and professionals the Across the globe, mergers and acquisitions are reshaping the corporate and competitive landscape. To help companies gain a strategic advantage and expand market share, this M&A program takes you inside the process—from strategy and valuation to execution and post-merger management.

Dec 26, 2017В В· Studies Show This 1 Thing Can Kill Any Merger or Acquisition Strategy Mergers and acquisitions have reached historically distressing levels of failure, with rates as high as 90 percent. On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

Mergers and Acquisitions: Cases and Materials, Second Edition is a concise, accessible, practical, and student-friendly presentation of everything law students need to know about mergers and acquisitions in order to hit the ground running in a transactional setting. Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions.

Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions. On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

E-mail: custserv@hbsp.harvard.eduThe Library of Congress has catalogued the paperback edition ofthis title as:Harvard business review on mergers and acquisitions.p. cm. — (Harvard business review paperback series)Includes index.ISBN 1-57851-555-6 (alk. paper)1. A recent article in the Harvard Business Review made a perhaps surprising conjecture: that as far as mergers and acquisitions are concerned, those companies that focus on what they’re going to get...

Harvard Business Review on Mergers and Acquisitions Presque tous les jours, les articles signalent une autre fusion, rachat ou joint-venture. Il est assez difficile de garder une trace de qui est propriГ©taire de la sociГ©tГ©, mais il est encore plus difficile de savoir si votre entreprise devrait participer au jeu. Case Studies and Other Experiential Learning Tools from Harvard Law School. Toggle menu. Mergers & Acquisitions; Mergers & Acquisitions. Sort By: Harvard Business School Publishing; HLS Executive Education; Harvard Negotiation Clinical Program;

Mar 27, 2006В В· 3/27/2006 There are nine "deadly sins" that can mess up any merger, according to Harvard Business School and MIT graduates now working for Booz Allen Hamilton. Most mergers fail at the execution stage and execution can be fixed. by Gerald Adolph, Karla Elrod, and J. Neely It's a nightmare lived out all too frequen... Dec 31, 2019В В· Though some view large-scale acquisitions primarily as the province of adventurous conglomerates, in fact many old-line conservative giants are actively involved in such activities. General Electric, for instance, paid $2 billion in stock for Utah International, Exxon paid $1.2 billion in cash for Reliance Electric, and Allied Chemical and

Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation. Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

“The Harvard Business Review Paperback Series” is designed to bring today’s managers and professionals the fundamental information they need to stay competitive in a fast-moving world. Be the first to review “Harvard Business Review on Mergers & Acquisitions” Cancel reply. context, mergers and acquisitions are likely to become an even more important consideration in strategic planning and strategy implementation in the future. In an article in the Harvard Business Review , Joe Bower suggested that most mergers and

3 days agoВ В· Learn to make deals that unlock shareholder value with the Mergers and Acquisitions programme from London Business School. including Business Strategy Review, Harvard Business Review and California Management Review. He has also co-authored a number of books and contributed to leading news outlets including the BBC, CNN, CNBC, The Times The Paperback of the Harvard Business Review on Mergers and Acquisitions by Harvard Business School Press, Alfred Rappaport, Robert G. Eccles, Michael D B&N Outlet Membership Educators Gift Cards Stores & Events Help

Mergers and Acquisitions Overcoming Pitfalls Building. Jun 06, 2018В В· Companies are increasingly paying for acquisitions with stock rather than cash. But both they and the companies they acquire need to understand just how big a difference that decision can make to the value shareholders will get from a deal., Aug 09, 2015В В· I admit, all of this is entertaining enough from a historical perspective. However, it should be beneath Harvard Business Review to keep on milking no longer relevant content for a few extra dollars profit at airports, college bookstores etc..

Harvard Business Review on Mergers and Acquisitions pptx

Harvard Business Review on Mergers & Acquisitions. Mar 27, 2006В В· 3/27/2006 There are nine "deadly sins" that can mess up any merger, according to Harvard Business School and MIT graduates now working for Booz Allen Hamilton. Most mergers fail at the execution stage and execution can be fixed. by Gerald Adolph, Karla Elrod, and J. Neely It's a nightmare lived out all too frequen..., Mar 27, 2006В В· 3/27/2006 There are nine "deadly sins" that can mess up any merger, according to Harvard Business School and MIT graduates now working for Booz Allen Hamilton. Most mergers fail at the execution stage and execution can be fixed. by Gerald Adolph, Karla Elrod, and J. Neely It's a nightmare lived out all too frequen....

Harvard business review on mergers and acquisitions

Harvard business review on mergers and acquisitions. (Book. Across the globe, mergers and acquisitions are reshaping the corporate and competitive landscape. To help companies gain a strategic advantage and expand market share, this M&A program takes you inside the process—from strategy and valuation to execution and post-merger management. https://fr.wikipedia.org/wiki/Fusion-acquisition Harvard Business Review on Mergers and Acquisitions Presque tous les jours, les articles signalent une autre fusion, rachat ou joint-venture. Il est assez difficile de garder une trace de qui est propriétaire de la société, mais il est encore plus difficile de savoir si votre entreprise devrait participer au jeu..

context, mergers and acquisitions are likely to become an even more important consideration in strategic planning and strategy implementation in the future. In an article in the Harvard Business Review , Joe Bower suggested that most mergers and On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

Nov 30, 2018В В· Mergers & acquisitions. The huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms' aggressive... Executives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term... Aug 09, 2015В В· I admit, all of this is entertaining enough from a historical perspective. However, it should be beneath Harvard Business Review to keep on milking no longer relevant content for a few extra dollars profit at airports, college bookstores etc.

Mergers and acquisitions (M&A) represent a popular strategy used by firms for many years, but the success of this strategy has been limited. In fact, several reviews have shown that, on average, firms create little or no value by making acquisitions. Case Studies and Other Experiential Learning Tools from Harvard Law School. Toggle menu. Mergers & Acquisitions; Mergers & Acquisitions. Sort By: Harvard Business School Publishing; HLS Executive Education; Harvard Negotiation Clinical Program;

Harvard Business Review on Mergers and Acquisitions Dennis Carey , Robert J. Aiello , Michael D. Watkins , Alfred Rappaport , Robert G. Eccles Harvard Business School Publishing Corporation , 2001 - Business & Economics - 220 pages Success of a merger or acquisition - A consideration of influencing factors Article (PDF Available) in International Journal of Management Practice 5(3):270 - 286 В· July 2012 with 5,098 Reads

Aug 09, 2015 · Harvard Business Review on Mergers & Acquisitions [Harvard Business Press] on Amazon.com. *FREE* shipping on qualifying offers. Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company A recent article in the Harvard Business Review made a perhaps surprising conjecture: that as far as mergers and acquisitions are concerned, those companies that focus on what they’re going to get...

I’ll also cover many of the aspects of mergers and acquisitions that you need to know for law firm interviews and case study exercises. Let’s begin with an example, which highlights the impact of mergers and acquisitions. In 2017, Amazon bought Whole Foods and … E-mail: custserv@hbsp.harvard.eduThe Library of Congress has catalogued the paperback edition ofthis title as:Harvard business review on mergers and acquisitions.p. cm. — (Harvard business review paperback series)Includes index.ISBN 1-57851-555-6 (alk. paper)1.

Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your Get this from a library! Harvard business review on mergers and acquisitions.. -- Annotation Almost every day the papers report another merger, buyout, or joint venture. It's difficult enough to keep track of who owns which company, but it's even more difficult to know if your

Harvard Business Review on Mergers and Acquisitions Dennis Carey , Robert J. Aiello , Michael D. Watkins , Alfred Rappaport , Robert G. Eccles Harvard Business School Publishing Corporation , 2001 - Business & Economics - 220 pages “The Harvard Business Review Paperback Series” is designed to bring today’s managers and professionals the fundamental information they need to stay competitive in a fast-moving world. Be the first to review “Harvard Business Review on Mergers & Acquisitions” Cancel reply.

Harvard Business Review on Mergers and Acquisitions Presque tous les jours, les articles signalent une autre fusion, rachat ou joint-venture. Il est assez difficile de garder une trace de qui est propriГ©taire de la sociГ©tГ©, mais il est encore plus difficile de savoir si votre entreprise devrait participer au jeu. On average, the acquiring companies in mergers with tight-loose differences saw their return on assets decrease by 0.6 percentage points three years after the merger, or $200 million in net income

3 days agoВ В· Learn to make deals that unlock shareholder value with the Mergers and Acquisitions programme from London Business School. including Business Strategy Review, Harvard Business Review and California Management Review. He has also co-authored a number of books and contributed to leading news outlets including the BBC, CNN, CNBC, The Times Harvard Business Review; FACULTY: Name / / Mergers and acquisitions . H. Douglas Weaver Professor of Business Law, Joseph Flom Professor of Law and Business . Secondary Interest. Malcolm P. Baker Robert G. Kirby Professor of Business Administration Arthur Lowes Dickinson Professor of Business Administration

“The Harvard Business Review Paperback Series” is designed to bring today’s managers and professionals the fundamental information they need to stay competitive in a fast-moving world. Be the first to review “Harvard Business Review on Mergers & Acquisitions” Cancel reply. Dec 26, 2017 · Studies Show This 1 Thing Can Kill Any Merger or Acquisition Strategy Mergers and acquisitions have reached historically distressing levels of failure, with rates as high as 90 percent.